Wayne A. Nygard, MAI, FRICS is the Division Chief for the Evaluations Division (“EV”) within the Bureau of Overseas Buildings Operations of the U.S. Department of State. EV is responsible for evaluation of U.S. Embassy and Consulate facilities and other real estate worldwide. The portfolio consists of over 25,000 properties in over 190 countries. Nygard oversees a staff of appraisers and real estate analysts who review and perform Market Value Appraisals worldwide as well as conduct various analyses including Lease – Purchase, Lease vs. Buy and Fair Market Rent Analyses.

The mission of the Bureau is to provide the most effective facilities for United States diplomacy abroad.

The IVSC caught up with Wayne to find out more about his role and background in valuation:

Overseeing property valuations in more than 190 countries surely poses distinct challenges. Can you shed light on the most prominent ones you face?

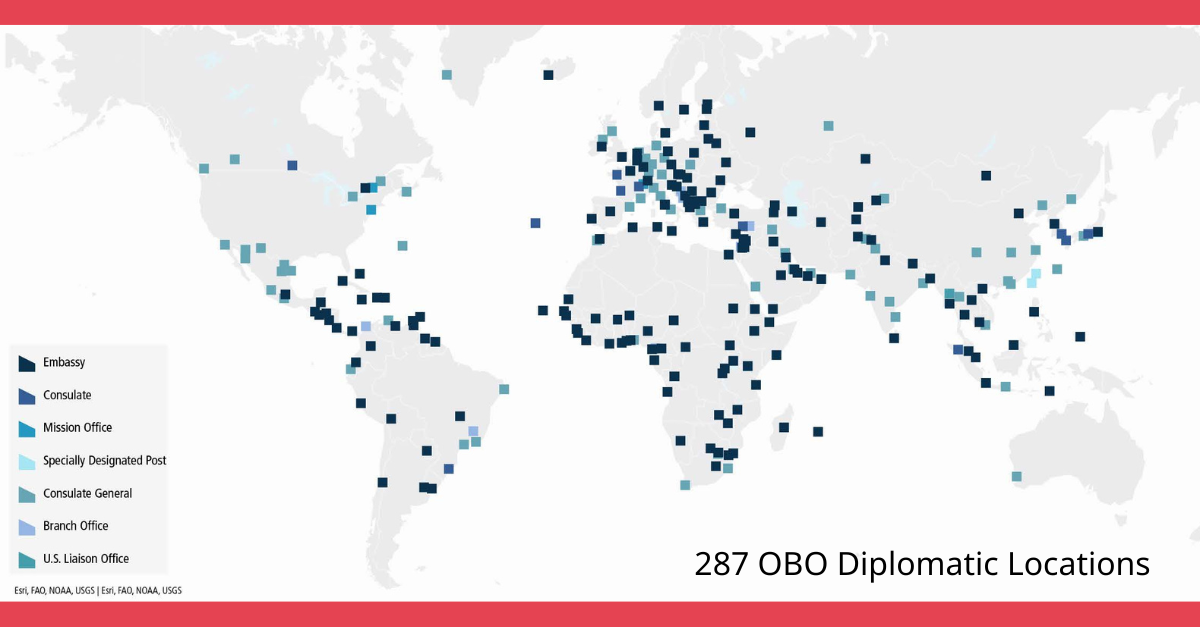

There is indeed a wide spectrum of challenges encountered across the portfolio. The Bureau of Overseas Buildings Operations (OBO) is the real estate section of the U.S. Department of State. The portfolio consists of over 25,000 assets (owned and leased) that include all major property types except retail in more than 280 cities.

We are in often unpredictable environments and face rapidly changing security risks, political and civil unrest, and evolving climate risks. The World Bank periodically issues a ‘Doing Business’ report in which they rank the ease of doing business. In 2020, the U.S. ranked #6 with a score of 84.0, Pakistan for example ranked #108, scoring 61. The ten most difficult countries scored from 40 to 20 – most of them are locations where we work.

‘Unique’ is the key word here for the challenges born not only from this widely dispersed portfolio but also for the unique properties in the portfolio. Think of OBO as the real estate department of an extremely large global corporation – not only does OBO have to provide an effective real estate platform to get the job done (embassies, consulates, office space, and warehouses) but also to house the 13,000 foreign service personnel and others who represent the U.S. abroad. In doing so, the real estate rule of location, location, location is wrapped by security, security, security. The resultant facilities often differ quite a bit physically from market norms.

But underneath it all is land, and the challenges associated with land ownership come in all shapes and sizes. At one extreme, in some countries the government owns all the land such as in China, Vietnam, and Laos. In these countries, our facilities require long-term leases, host government approvals, and the rights under our leases may be at the whim of the presiding regime. Local expertise is needed to understand the local regulations and how to incorporate them into a proper valuation. For a specific example, Indonesian land ownership is principally regulated under the Basic Agrarian Law which includes the Right to Cultivate (Hak Guna Usaha – HGU Title), Right to Build (Hak Guna Bangunan – HGB Title), and Right to Use (Hak Pakai – HP title). In a comparable analysis, these rights must be considered. The U.K has some of the most sophisticated leasehold regulations borne out of a long history of leased land. We’ve relied heavily on our local experts for guidance with Leasehold Reform, the intricacies of enfranchisement, marriage value, and all those other wonderfully British elements foreign to us in the States.

Land ownership in lesser-developed countries can be challenging due to incomplete record-keeping, or in some locations the absence of ownership records due to destruction in war or confiscation by regimes.

In addition to various land ownership issues, data privacy may lead to very different approaches to land valuation. Germany, for example, established local expert committees (Gutachterausschüsse) to ensure real estate market transparency while maintaining a high degree of data protection. Here, the committee receives actual sales information and, among other tasks, publishes standard land values. These serve as benchmarks in land valuation. Similarly, in Japan the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) publishes a price index survey based on real estate transactions. Using a residual method land values are benchmarked and mapped. To a typical U.S. appraiser, the notion of a land map indexed with values is unusual – though I do recall seeing such maps of land values in The Bronx!.

At the core of valuing such a diverse portfolio is understanding the jurisdiction in which each property is located. To accomplish this, OBO’s Evaluations Division employs contractors with the jurisdictional competency required for each assignment. Local competency combined with the professional judgement of our in-house appraisal staff enable us to provide sound valuation guidance in these diverse markets.

”Think of OBO as the real estate department of an extremely large global corporation – not only does OBO have to provide an effective real estate platform to get the job done (embassies, consulates, office space, and warehouses) but also to house the 13,000 foreign service personnel and others who represent the U.S. abroad.

What's been the most intriguing or unique property you've come across during your reviews, and what made it stand out?

Coming from the private sector where appraisals of trophy office buildings, resort hotels, regional malls etc. can become routine, the Department of State properties at a glance may seem simple, in a way – staff housing, representational housing, land and diplomatic facilities. Upon closer examination however, the properties often have unique features, historical significance, or both. Representational housing is always fascinating to me, particularly for the history contained within the walls.

The Tokyo residence was one of the first purpose-built Chief of Mission Residences (CMR). The two-story home measures about 2,700 square meters on a 6,000 square meter site in downtown Tokyo. General Douglas MacArthur lived in the home after the second world war and it was here, in September 1945, that Emperor Hirohito made an unprecedented visit to MacArthur’s home – people came to the emperor not the other way around. As for the valuation, this is a low-rise, low-density structure in a high-density CBD with historic significance and on leased land. Needless to say, the highest and best use analysis was tricky.

The U.S. Ambassador’s residence in London – the Winfield House also has quite a distinguished history. This 3,500 square meter Georgian-style mansion was built by Barbara Hutton, an heiress to the Woolworth estate on a twelve-acre estate in Regent’s Park. The house was completed in 1938. After the second world war, Hutton offered it to the U.S. government for the price of one dollar for use as the ambassador’s residence. The estate size within the City of London is second only to Buckingham Palace. The finishes are as impeccable as they are unique, such as the 18th century, hand-painted Chinese wallpaper in the Garden Room. The building is listed on the National Heritage List for England.

The U.S.-built improvements are on leased land which presents several complex valuation issues all subject to England/Wales Leasehold Reform laws. The listed nature of the improvements, the use of the property, and treatment of the site’s improvements all combined for a sophisticated valuation that required specific, local expertise.

As far as unusual properties, I’d say geopolitical issues rather than the physical real estate have also made for some of the more unusual assignments. Without going into detail, imagine that with 280 locations outside the United States, and all that is happening in the world, there are real estate stories you just don’t come across at home. Stated another way, watch the world news, and consider that there is a real estate story we are working on behind nearly every news item.

U.S. Embassy, Nine Elms, London

One property I did not value but which created a domino effect of other valuations was the U.S. embassy in Nine Elms. I had the opportunity to tour the property and meet with our ambassador at the time, Robert Wood Johnson IV. It is a remarkable building which replaced the Grosvenor Square property. The sale of that property financed the new embassy. The design concept was to architecturally represent hospitality, transparency, and sustainability all while providing a high level of security. The building sits within an urban park with many of the security features incorporated into the landscaping and the building’s design.

At the time the site was purchased, Nine Elms was a very different neighborhood. While the Battersea Power Station redevelopment had been batted about for decades, the new U.S. embassy provided the catalyst for redevelopment. The improvement around the area, we refer to as ‘embassy effect’ which translates to the positive social value created by such a significant, long-term investment in a neighborhood.

The Embassy Gardens development has led the regeneration of the entire Nine Elms area of London.

”The improvement around the area, we refer to as ‘embassy effect’ which translates to the positive social value created by such a significant, long-term investment in a neighborhood.

Throughout your distinguished career, how have you witnessed the transformation of the valuation profession? Has the way the Department utilises the evaluations from your team changed over the years?

Well, I ‘walked in the door’ to appraisal so to speak on November 13, 1980 – and, while valuation principles and techniques remain pretty much the same, the tools used to develop opinions of value and the training for using these tools have changed drastically. Back then, terms like cut and paste, cc (carbon copy), Xerox (as in a copy) all meant exactly what they said. Boilerplate was literally cut from a ‘Xerox’ of a prior document and pasted onto a page with original writing and then turned over to a typing pool. Glossy photographs from film cameras were mounted into the final documents.

While writing reports today remains a significant time commitment, word processing is so much faster, and today’s programs are so much better than the early days of Wang Word Processing for example. Data gathering in the past meant maintaining clipping files from newspapers and magazines, trips to the county clerk’s office, visits to other appraisers’ offices, etc. Today, most research is possible from one’s computer accessing a variety of on-line data bases. While this has opened the door to a flood of information that never before could have been assembled in a reasonable period of time, it also calls for a higher degree of verification.

As for the analytics, my first cash flow, somewhere around 1982(???) was of a multi-tenant industrial park in Garfield, New Jersey when I was at Chase Manhattan Bank. The calculations were done by hand, in pencil, and laid out on an analysis pad. Excel and the wide variety of real estate analytical programs that have followed permit sensitivity and feasibility analyses that were much, much more time consuming earlier.

Chief of Mission Residence, Tokyo, Japan

When I began appraisal, the challenge was for an appraiser’s tools to keep pace with the appraiser’s ability to analyze, document, and communicate the findings. That has since flipped and particularly with AI now poking its head into all manner of services and trades, our minds are challenged to keep pace with data availability, computing speed, and the skills to master these ever-evolving tools. The importance of continuing education has never been so critical to keep pace.

There are pluses and minuses to this compression of time. On the one hand, valuation requires judgement which requires careful consideration of data and application of appraisal techniques – often an iterative process of testing various scenarios and assumptions. There have always been tough deadlines but in years past there was ‘time between’ for careful consideration. In the current environment, data can be transmitted from the source to the user instantaneously. Since data delivery is immediate – there are no (or fewer) trips to the library, to the county clerk, and no waiting for mail reply. Now, valuation users expect appraisals to be completed in shorter and shorter time horizons. And they can be completed more quickly…to a point. The actual ‘appraisal process’ hasn’t shortened and in fact is becoming broader with considerations of environmental, social, and governance (‘ESG’) factors.

No doubt the pluses outweigh the minuses – I would never want to go back to my analysis pad, I love my digital camera, and two flat screens while listening to YouTube jazz in the background. These advances do require new scrutiny of former valuation methods, techniques, and standards. The recent IVS exposure draft includes a new section on data and inputs and another on valuation models. I find these sections particularly timely with the expanding use of chatbots and AI in general. The data section, using the word ‘must’ in places calls on the valuer to ensure data is accurate and appropriate. Verification always was a cornerstone of competent appraisal. It will continue to be so, though could become more complex. In the new valuation model section of the draft, the word ‘must’ is also used placing the onus on the valuer to assess and understand valuation models incorporated into an assignment. While standard setters and valuation organizations need to keep up with the times, it is ultimately the valuer’s duty to ensure that the data in the report is relevant and adequate and that the methods and techniques are appropriate for the valuation.

At the Department of State our assignments, while at times are not analyses of your ordinary properties or locations, they follow accepted appraisal principles and standards. Since the valuations are overseas, we require compliance with accepted local standards as well as globally applicable standards such as International Valuation Standards when we work with third parties. In many of these locations, the depth of data available is much shallower due to lack of data infrastructure and/or data protection laws. In these cases, data research is much like years ago and relies on personal contacts and local authorities. The third-party appraisals that we commission however are not the end-all to our valuation assignments, but are tools that we use, in-house, along with our own property files and experience to develop the official opinions of Market Value and Market Rent used by the Department for acquisition, disposal, leasing, and planning. An important distinction is that unlike private appraisal practice, we as professional appraisers are employees of our ‘client’. As such the final report of value may only be a first step in a broader advisory function.

Following the completion of an appraisal, we may be called upon to develop alternate valuation scenarios and provide support for lease or purchase negotiations. With the advances in data visualization tools, the various analyses can be effectively presented not only in-person but also remotely using Teams, WebEx, and other meeting platforms. We are also exploring platforms such as ArcGIS StoryMaps as a means to communicate our appraisal findings in a dynamic format that guides the valuation user along the valuation’s path.

”The recent IVSC exposure draft includes a new section on data and inputs and another on valuation models. I find these sections particularly timely with the expanding use of chatbots and AI in general.

A design objective of the OBO was for the Nine Elms Embassy to be carbon negative

Why are globally agreed upon/applied valuation standards critical in your line of work?

Broadly accepted standards are critical for all types of products and services. They bring transparency that enhances comparability of products and services, they call for accountability of the producers’ work, and ultimately support a more efficient market. Standards also promote public trust. For us this is incredibly important as we are subject to Congressional oversightand, while most organizations are accountable to shareholders, our stewardship and accountability are to the American taxpayer, which mandates a very high fiduciary obligation.

As for valuation standards and specifically global valuation standards, they are our common real estate language. It’s like a book you and a friend have both read and can intelligently speak about and compare notes. I’ll never forget a terrific meeting I attended in a Tokyo appraiser’s office. Tokyo is a fascinating city though I found it also somewhat difficult to maneuver from my western perspective. I don’t know the language, can’t read the signs and after-hours communication was a bit difficult.

In the meeting however, not only did our hosts speak impeccable English but we were also able to discuss data collection, analytic methods, highest and best use, and other valuation concepts with complete understanding. My hosts had not only mastered the English language but also what I consider a subset of English, the language of real estate valuation and the standards by which valuations are performed.

”Valuation principles remain the same, but the tools and data have changed drastically.

By having common standards to work with, expectations can be managed. My Japanese colleagues had a clear conception of the scope of work and therefore the time and resources required. On our side, we had confidence that appraisers fully understood what we expected in the final product which ultimately was delivered to our satisfaction. For both sides, the element of risk was greatly reduced.

It is one of the great rewards of this job to have these interactions with appraisers from such a wide range of cultures, exchange stories, and when it comes to business relate to each other seamlessly due to the common denominator of global valuation standards. I’ve experienced it not only in Tokyo but also in Abuja, Moscow, Almaty and Tallinn where, thanks to global standards we valuers have a common understanding of each other’s expectations.

In addition to valuation standards, I think it’s also important to mention ethical standards as well and their role in ensuring public trust. In the U.S. for example The Appraisal Institute requires their members and others affiliated with the organization to comply with a Code of Professional Ethics which ensure, among other things, impartiality. Similarly, the International Ethics Standards Coalition developed standards to address conduct and accountability of appraisers. Circling back to my initial comment, by adhering to both international valuation standards and ethical standards, we offer guidance that informs proper stewardship of U.S. taxpayer dollars.

U.S. Embassy N’Djamena, Chad

Principles-based standards, as opposed to highly prescriptive technical standards, have gained prominence in numerous fields. Can you elaborate on their importance in the realm of property valuation?

The nice thing about principles-based standards is that they permit more latitude and focus on concepts rather than technical or rules-based standards which can be more prescriptive. This is particularly important when we are talking about global valuation standards where cultural differences in property ownership, data availability and valuation methodology would make a single set of technical-based standards difficult, if not impossible to implement. Most, or at least many countries mandate that professionals who perform real estate appraisals must be certified or licensed, yet the requirements under each vary. Similarly, standards such as the International Valuation Standards (IVS) or, in the U.S., the Uniform Standards of Appraisal Practice (USPAP) have a similar goal – to promote public trust in the valuation industry by establishing clear and consistent appraisal practices. Considering our global portfolio, we require adherence to internationally recognized professional appraisal standards and practices such as IVS.

”By adhering to both international valuation standards and ethical standards, we offer guidance that informs proper stewardship of U.S. taxpayer dollars

A fundamental principle of real estate is ‘uniqueness’. Because of this, valuations necessarily reflect the culture in which a property is located. While the concept of market value, willing buyer – willing seller, on a given date, etc. is fundamentally the same in most if not all countries, the methods and techniques used to arrive at an opinion of value varies. The U.S., U.K, Japan, and Germany have all had valuation methods and techniques that have worked well in their markets (the U.S. being a relative youngster). The specific methods and techniques however differ, reflecting the legal framework of each country. In the end, an appropriate valuation is one that models the mindset of a typical investor in the local market. Principles-based standards permits cultural flexibility while maintaining a focus on the basic valuation concepts.

Principles-based standards also are better adapted to the fast pace of technological change. The latest IVS exposure draft does a nice job addressing valuation models for example without prescribing any particular model but acknowledging the wide use of models, requires the valuer to select an appropriate model and understand the model. The principles embodied in the valuation model section ensure transparency, accountability, efficiency and continue to provide a basis for public trust. The guidelines are a great step in that direction.

As we look ahead, how do you envision the evolution of valuation standards and the skills required of valuers? Are there specific emerging trends or issues that we should be particularly mindful of?

A valuer is not expected to have more information than the market or abilities beyond those of market participants. Valuations are reflections of the market, so a valuer must keep pace with the market and understand any given market in which they work as well understand how participants in that market evaluate real estate. This requires not only staying abreast of market trends and news but also the evolution of the hardware and software used by market players to make informed decisions.

Valuation standards are constantly evolving. The IVSC exposure draft that I’ve previously mentioned was released precisely to keep pace with changing market standards. The draft included commentary on technology, data sources and, very importantly environmental, social, and governance (ESG) factors. The latter is, in my experience, a very new facet for valuation standards.

When I began my career, environmental, social, and governmental forces that affect real estate were (and still are) part of principles of appraisal and taught in the most basic appraisal courses. What is new however is that the importance of these forces has moved from the general to the specific – meaning from understanding these macro forces and how they influence property markets to incorporating local standards and regulations that are being put into place.

In New York City for example, Local Law 97 enacted in 2019 intends to reduce carbon emissions to 40 percent by 2030. This will require the thousands of NYC landlords to meet energy efficiency requirements or pay steep penalties. This has a direct impact on income and expense analysis, comparative sales analysis and valuations based on cost where inefficient systems are depreciated and costs to cure incorporated. The United Kingdom Energy Performance Certificate (EPC) rating will certainly affect valuations as properties that score with highly efficient ratings may receive a premium as opposed to those requiring improvement. These are specific examples of how both standards and valuer’s skills must keep pace with the market.

The tools of valuation evolve as well and require updates in standards and skills. Again, the latest IVS draft incorporates language related to data, data sources, and modeling. Availability of data seems to expand exponentially. The myriad of sources available via the internet is astonishing – at least compared to pre-internet days when appraisers relied on printed matter and contacts within the trade. An advantage to the old ways of personal research of source documents was verification. Source documents and personal interviews generally provided a high-level of confidence. Internet research, while opening doors to new sources daily requires a high level of verification. This is mentioned in the IVS draft section on Data and Inputs which places the responsibility for the data used directly on the appraiser. I can see this becoming ever more of a challenge in this day of Artificial Intelligence. Valuers have always been responsible for keeping pace with markets and the technologies to analyze them. The specialization of technologies will likely lead to specialization of efforts in valuation and developing teams capable of handling the complexities.

As technology continues its swift progression, how have digital solutions reshaped your methods in property valuation?

In a sense nothing has changed though everything is different. The principles of appraisal are the same – the four forces that affect property values: Social, Environmental, Governmental and Economic are the same. The four factors that create/maintain property value: Scarcity, Demand, Utility and Effective Purchasing Power are unchanged. We (I) learned these forty years ago and teach the same today. They form a great foundation for beginning any real estate valuation.

But 40 years ago, we used typewriters, telephones, and the ubiquitous HP-12C calculator (which I still use!) to tackle the most complex real estate problems. Real estate appraisal is research, writing and communication. The research component I mentioned previously regarding the plethora of data now available via internet has taken the place in many cases of trips to the county clerk.

Digital photography has been a game changer. Whereas in years gone by, we went into the field with a film camera and had to make every shot count – not knowing whether you got the shot until the film was developed (we paid extra for same-day developing), today’s fieldwork benefits from digital photography, video, drones, and GIS mapping to provide an ‘almost’ in-person site visualization. I say ‘almost’ very purposefully.

The visual aids valuers are now able to incorporate into their work product are as amazing as they are informative. Nevertheless, and in my opinion, a site visit is integral for both the valuer and the user of the valuation. During the Covid lockdown, site visits by my team were not possible and we relied heavily on visualization provided by digital technologies.

Fortunately, the Covid lockdown is over and site visits are possible again. In my opinion, a site visit, particularly at different times of the day informs on the surrounding land uses, pedestrian, and vehicular traffic….in general the sights, sounds, and feel of a neighborhood and a property. My hope is that we never become so enamored with our technology to lose the human experience of real estate.

Covid led to a leap forward also in communication technology. What began as an experiment in telework is now the norm. The tasks of appraisal, researching, analyzing, and writing do not demand an office presence and during the Covid lockdown, appraisal production continued at the same pace or maybe faster than pre-Covid. Development and refinement of platforms such as Teams, Zoom and WebEx enabled meetings with vendors around the world and document sharing provided for higher degrees of collaboration.

These digital tools and technologies underpinning telework feasibility for appraisers will not change the appraisal process but have already changed appraisal production. What we as appraisers need now to understand are the limitations of our new tools. For example, at what point do we say, an in-person meeting is required, or an in-person site visit is necessary. In a time of shrinking budgets, what is the cost/benefit of these more time intensive, hands-on methods. The guidance I use for my team is, as the sensitivity, complexity, and dollar volume of an action increases so does the need for in-person expertise.

U.S. Ambassador’s residence, Winfield House, London

”Understanding the limitations of our new tools is crucial [...] My hope is that we never become so enamored with our technology to lose the human experience of real estate.

As the Division Chief, your role involves overseeing diverse types of analyses like Lease-Purchase, Lease vs. Buy, and Fair Market Rent analyses. How does the decision-making process vary across these analysis types?

”Security, resiliency, location, and stewardship are key factors in alternatives analyses.

I mentioned earlier that security is at the forefront of our ultimate decision making and to understand real estate decision making at OBO requires first a bit of background as to the legislative framework in which we operate. The old days of zero lot-line, embassy row is sadly a thing of the past. As a reaction to attacks on U. S. diplomatic facilities abroad, Congress enacted the Omnibus Diplomatic Security and Antiterrorism Act of 1986 which among other things established the State Department’s Bureau of Diplomatic Security. From the 1998 bombings of U.S. embassies in Kenya and Tanzania, came the Secure Embassy Construction and Counterterrorism Act of 1999 (SECCA). This piece of legislation has been key to OBO planning, designing and locating new embassies around the world. Among other things, SECCA requires a 100-foot building setback unless otherwise waived. Since the enactment of SECCA, OBO has built over 177 new diplomatic facilities. Each one of these begins with an analysis of alternatives.

When we evaluate new locations as well as existing facilities, security, resiliency, location as it relates to the mission, and stewardship are key factors in alternatives analyses. Cost-benefit analyses are an important part of proper stewardship of not only the facility in question but taxpayer funds in general. The level of detail used in these types of analyses is commensurate with the size and criticality of the investment as well as where we are in the planning process. When we – and by we, I mean a larger collaborative group of stakeholders – look at the benefits, it is in terms of the mission’s needs and goals that are identified during our planning sessions. These benefits as well as the costs consider the property lifecycle as well as the opportunity cost of alternative paths.

Unlike the private sector where rates of return provide the benchmarks for decision makers, security and diplomatic factors carry equal if not greater weight than cost in the ultimate decision process. The real estate path forward impacts a policy decision about whether diplomacy will be furthered by an action. The cost of one option may be higher than an alternative, but may nevertheless represent the ‘best value’ for the U.S. government due to diplomatic factors.

”The cost of one option may be higher than an alternative but may represent the 'best value' for the U.S. government due to diplomatic factors.

Here’s an example:

Let’s say we are studying one of our older, embassies situated in the center of downtown in a culturally /architecturally significant building that no longer meets setback standards. Options will include 1) stay in-place with a major rehab which could include mothballing or demolition (if possible) of the non-compliant space, 2) acquiring an existing building and retrofitting for our use and security requirement, or 3) acquiring land and building new. Of all three, security requirements would be fully met when a new building is designed and built on newly-acquired site. On the other hand, with a new building/new site we lose a central city location that cannot be duplicated as well as a notable structure. Now, let’s say a property search locates a suitable existing building but the retrofit costs place it above even the cost to build new and does not result in a fully compliant building. Of the two remaining options, let’s assume building new on a new site is cheaper than staying in-place with a full retrofit. In this case, the stay in-place still could be the optimal option. If the security profile of the post is on the low end and any non-compliance could be waived, the social factors of being closer to our contacts, perhaps decreased travel time, and the architectural significance of the structure may have a non-monetary weight greater than cost alone.

Computer Generated Image of the new U.S. Embassy in New Delhi, India

You have been actively involved with professional bodies such as the Appraisal Institute, HypZert, and RICS, all of which are key members and sponsors of the IVSC. Can you discuss the significance of this work outside the Department and how these organisations are contributing to the advancement of the valuation profession on a global scale?

Let’s start with The Appraisal Institute since that is how my career developed. The Appraisal Institute (AI) in the U.S. is the premier provider of real estate appraisal education and training. The organization maintains active involvement in regional and international real estate federations including not only the International Valuation Standards Council but also the International Real Estate Federation, the Union of Pan-American Valuation Organizations and the International Federation of Surveyors. With the AI, I’ve been a member of the International Relations Committee. The committee has worked to share AI’s educational standards and educational materials abroad particularly in markets where standards and training are less prevalent or emerging.

AI’s central text, The Appraisal of Real Estate is available in Spanish and many of the AI’s courses have been taught in Asia, Europe and the Middle East. Personally, I taught several valuation courses in English as well as German in Germany which all were drawn from my Appraisal Institute training.

This is a good segue to my friends at HypZert where my involvement goes back probably 20 years or more. To make a long story short, having been born in Würzburg Germany, I was always fascinated with the country, despite growing up in far-away New Mexico. I studied German and, fast forward, after about 15 years in the U.S. valuation business, I began exploring how I could merge my interest in Germany with appraisal.

”The Appraisal Institute’s International Relations committee has worked to share AI’s educational standards and materials abroad, particularly in emerging markets.

Wayne (right) with HypZert CEO, Reiner Lux

This led me to HypZert eventually – a fairly new organization at that time with around 400 members. Now, with over 2,200 valuers in Germany and worldwide, HypZert is the largest accredited certification body for real estate valuers in Germany. Their particular expertise is mortgage lending valuation. I had the honor to become the first non-German national to become certified by HypZert. The group has done a phenomenal job publishing German and English language monographs on valuation of a wide variety of property types as well as markets. Their on-line and in-person training helps keep valuers up-to-date with topics on regulatory changes, markets and new technologies.

RICS is the granddaddy of valuer organizations with over 135,000 members in every major market. I can remember first hearing about the Royal Institution of Chartered Surveyors when I was an apprentice appraiser in Manhattan in 1980. It sounded pretty lofty and impressive. Much later and with quite a bit of water under the bridge, I’m proud to say that I am a RICS Fellow. Little did I know back in the early 1980’s when I was doing real estate tax reduction work in the South Bronx, that I would be looking towards RICS members to value the worldwide portfolio of the Department of State. RICS has the broadest band of published and on-line materials covering the many survey specialties, global markets, business practices as well as timely topics such as sustainability, diversity/equity/inclusion, and forced labor. Similar to my earlier comments about global standards, when I work with valuers from Australia to Zimbabwe and all places in between, the RICS designation highlights a valuer with whom I can ‘talk shop’ in the common language of appraisal.

Finally, as an established leader in your field, what advice would you impart to someone embarking on their career in real estate valuation, particularly if they aim to work on a global scale?

It all begins with the basics. I probably lean most heavily on the principles and procedures learned in my first Appraisal Institute class when unraveling the complexities of a real estate valuation puzzle. In all the places I’ve worked, the basic appraisal classes were essential courses for all personnel whether line or staff and that continues with my team at State. We are all appraisers at heart, comparison shopping for apples, cars, phones….and real estate – making adjustments for positive and negative attributes. The basic classes organize and expand on this natural decision-making process.

It’s funny, when I left high school, I remember thinking that I was so done with math. Later in college Finance was the course I dreaded. How was I to understand six functions of a dollar – I only knew two – spend or save! Fear of math should not be a deterrent. I’ve taught income capitalization, discounted cash flow analysis, cash equivalency, the six functions of a dollar (in German as well!) and the math we do as appraisers can be demystified.

What I would encourage someone embarking on their career in valuation is to develop high level communicative skills – writing and speaking. And in our ‘new world’, on-line presenting. During the early Covid period, we contacted specialists to develop a course in on-line presenting. With all types of communication, one’s brilliance will go wasted if it is not communicated clearly.

For those interested in a global career, explore the websites of the organizations mentioned earlier. There is a wealth of information on how to begin a career in global real estate valuation. Begin to associate with others in the global real estate business by attending events either in-person or virtual. Use social media to associate yourself with global real estate groups. While it is not essential, I encourage people to learn a different language. Yes, English, at least for now, is the international language of business. Speaking another language however provides a level of access to people not possible for English-only speakers. It shows a high degree of interest in another culture; it shows respect.

One of the nicest compliments I’ve received was from a German colleague when we were talking about our real estate associates. He said something about the Americans but then added, ‘well, you are not really American.’ Mind you there is nothing wrong to be an American and I will always remain one. What he meant was that I’d separated myself from the pack by assimilating their language and culture – I’d achieved a degree of trust closed out for many of my countrymen. To have another language is to possess a second soul.

There are many soft skills that I emphasize with people new to the profession. Be observant. My first boss in the industry, Ralph Marx – a wonderful guy – grew up in Manhattan. His father would walk him to school in the morning, same route every day, and would say “Ralphie, notice something new every day.” I think that is wonderful advice, particularly these days when people walk the streets engrossed in their phones. A good appraiser is attentive and notices details, materials, street activity.

Lastly, do not lie and tell the truth no matter how hard. My strongest business relationships are built on years of trust. That is the most important thing in any type of relationship. It takes years to develop a good reputation but only a moment to lose it.

”My first boss in the industry grew up in Manhattan. His father would walk him to school in the morning, same route every day, and would say “Ralphie, notice something new every day.” I think that is wonderful advice. A good appraiser is attentive and notices details, materials, street activity.

IVSC is grateful to Wayne A. Nygard for his time and insights in preparing this Professional Insights paper.